A new venture capital

technology fund

for Latin America

A NEW HORIZON for Venture in Latin America

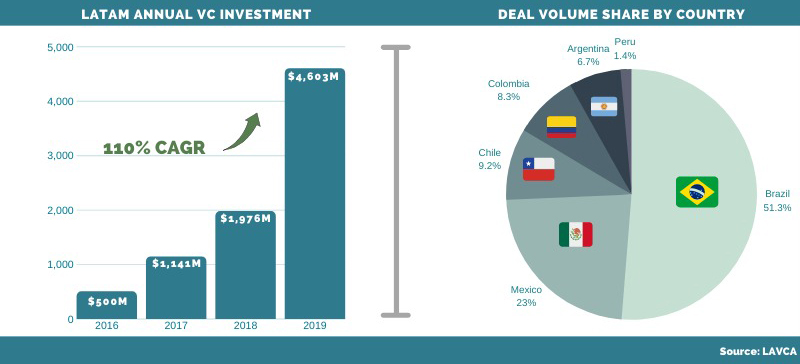

In the last decade, Latam has seen remarkable growth in VC tech investing; by end of 2019 it will total more than $18B+

LATAM TECH ECOSYSTEMS

The region now has several hubs of developed, consolidated tech ecosystems, with strong early and seed stage incubators, entrepreneur networks, and investors The driving catalyst for this unprecedented rise in Latam Tech is a steady influx of entrepreneurs that have gained experience in more developed markets Key in these ecosystems, is the rapidly growing pool of topnotch engineering talent, including more than thousands of new developers and other technical disciplines graduating every year from top universities.

THE INVESTMENT GAP – SERIES A

Most tech startup investors in the region are focused on seed investments with occasional private equity checks also available, leaving a massive gap in investment opportunities.

The region is producing innovative tech startups, with acclaimed investors and conglomerates.

THE OPPORTUNITY

Tier I regional markets (Mexico and Brazil) have seen a flurry of mostly unfocused investment activity, leading to fragmented Tech investor ecosystems that are difficult to penetrate

Tier II markets are still underserved on the investment side – particularly Colombia and Argentina

Tech startups generating meaningful traction in these countries could readily scale with focused strategies on regional ancillary markets, except that startup founders here have the exact same problem as the investors

Investment overview

HYBRID SERIES A GROWTH CAPITAL

We get Founders unstuck from the vicious cycle of nonexistent Series A financing. Series A checks are deployed with a hands-on approach, with a particular focus towards generating regional exits. Focused capital – we help generate exponential growth for our Founders, with strategies that don’t sacrifice sustainability in Latam’s unique operating environment. Unparalleled access to existing funnels of early stage investments for great deal flow.

Our team is uniquely qualified to create immediate, lasting impact in the Venture Capital Series A investment gap.

THE PARTNERS

PORTFOLIO

LiftIt is an IT (mobile app and web-based) platform for scheduling B2B cargo shipments of all sizes by connecting independent truck drivers and companies requiring transport services. Recurring, monthly contracts are negotiated with clients with a base charge plus extra fees at a determined rate for excess volume.

Alquilando is an online marketplace for long-term rentals in Argentina and Colombia that simplifies the rental process, minimizes risk and guarantees payments.

MiAguila provides legal ride sharing services in key Colombian cities, specifically targeting the transportation needs of businesses and their executives/employees through shuttles and private cars.

RetailApp is an enterprise-wide solution for monitoring retail KPIs and driving communications at all levels of the organization around them. The centralized platform is quickly integrated, and supplements other solutions that companies may already have by integrating them together into one simple, central location.

GAIA is a vertically integrated online-to-offline furniture brand that makes quality design furniture more accessible in Mexico. By producing its own products locally and managing deliveries, it guarantees excellent customer service.

OFI is a managed service provider and systems integrator that started in Colombia and has now expanded to the rest of LATAM (Ex-Brazil). It focuses on being a one-stop-shop for a wide array of solutions, such as enterprise mobility, help desk, hybrid cloud, supply chain outsourcing, app development, and machine learning.

Omni|Bnk is LATAM’s first NeoBank for business. It is able to evaluate SME credit requests up to $1M USD within 24 hours via its advanced invoice validation, client-side risk analytics, payroll/tax compliance monitoring, and consolidated supply chain alert system.

Simetrik is an enterprise-wide solution for data standardization and reconciliation. The software delivers key insights and error reporting across disparate sources ranging from bank accounts to ERP systems.

Elenas is a digital platform that aims to modernize the direct sales market in LATAM, which is 3x larger than e-commerce. It does this by digitalizing the highly manual value chain in the industry, providing benefits for brands, sellers, and consumers alike.

Justo (www.getjusto.com) is a Chile-based venture that operates a marketplace for Restaurants that allows stores to set up their own online presence and logistics, avoiding the costly fees charged by UberEats and Rappi.

Frete is a Brazilian technology freight platform that makes it simple to transport diverse products throughout LATAM. Currently, the company counts over one million truckers and over ten thousand shippers on its platform.

VEXI is a Mexican credit card provider focused on enabling first-time users to grow their credit and have equal access to financial services. They currently serve over one hundred thousand customers.

Billpocket provides a solution that converts mobile devices into point of sale terminals, allowing easy acceptance of credit or debit cards. The company has many other complementary solutions which facilitate merchant transactions.

Wonder Brands 'WB' is an incubator for Digitally Native Vertical Brands 'DNVB'. The Company performs disciplined acquisitions of high-potential sellers in the LATAM region, primarily transacting on the MercadoLibre and Amazon platforms. After the acquisition, WB supports the portfolio companies’ growth with structured operations, industry expertise, and capital.

Katapult is a SaaS software provider for eCommerce operations, focused primarily on the Mexican and Colombian markets.

INVESTMENT SPHERES

The alpha4ventures team is looking to bring to bear our collective domain expertise to invest and craft strategies for a broad range of tech ventures.

E-COMMERCE

FINTECH

MARKETPLACES SAAS

LOGISTICS TECH

CONTACT US

We're looking for your ideas, interests, and startup plans! Get in touch at info@alpha4ventures.com